The take-home All Spirits market in the UK is now worth £6.5Bn annually. Value sales in the All Spirits super category are down by -0.3% in the latest 12M (L12M) versus (vs) last year (LY), with volume sales down -0.6% in the L12M vs LY. However, performance differs markedly by category, Spirits are down -2.1% in value vs LY in the L12M and -4.7% in volume, with gin the worst performing sub-category, whereas in Ready-to-drink (RTD) Spirits volume sales are up by 11.1% year on year (YOY) in the L12M driving a YOY increase of 16.3% YOY over the L12M.

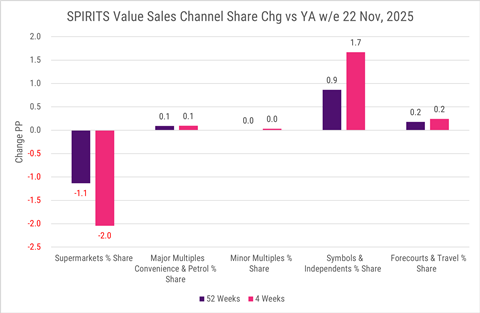

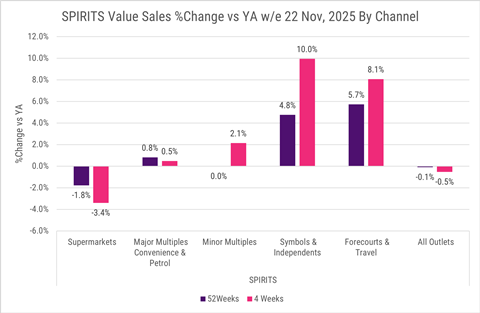

The Symbols & Independent channel has a value share of over-index in Spirits, with a channel share of 18.8%, in the L12M, but the channel has a much more significant over-trade in the RTD Spirits category, with a 33.1% share of the sub-category. With RTD Spirits in strong growth, the big over-trade in RTD spirits for Symbols and Independent retailers has helped the channel to grow its market share of All Spirits. Not only is the Symbols and Independent channel out-performing supermarkets in the RTD Spirits sub-category with annual value sales growth of 23.4% versus supermarket growth of just 12.8%, the channel is also out-performing in the two key sub-category markets of whisky and vodka, with growth respectively of -0.4% and +0.8% versus YOY growth in Supermarkets of -2.5% and -2.8%.

Somewhat counter-intuitively, Spirits and RTD spirits is one of a handful of categories where Symbols and Independent retailers are strongly out-performing the Supermarket channel, making it a crucial revenue stream for Symbols and Independents.

No comments yet