Retailers are still not making the most of the opportunity in no- and low-alcohol beer. So why not jump on the exciting trend by using these insightful tips from Asahi UK.

No- and low-alcohol remains the fastest-growing segment of the beer and lager market, with sales up by +18% in the past 12 months. [Nielsen]

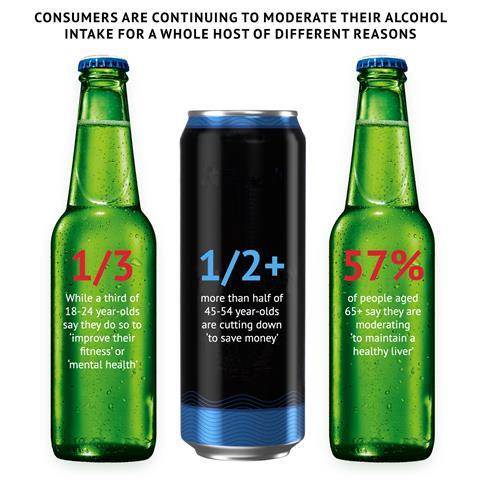

Consumers are continuing to moderate their alcohol intake for a whole host of different reasons. While a third of 18- to 24-year-olds say they do so to ‘improve their fitness’ or ‘mental health’, more than half of 45- to 54-year-olds are cutting down ‘to save money’. Fifty-seven per cent of people aged 65+ say they are moderating ‘to maintain a healthy liver’. [CGA]

Despite rising consumer demand and need, convenience retailers still aren’t making as much of the opportunity as they could be. In grocery, 7.9% of beer SKUs are no- and low-alcohol, by distribution, whereas in convenience just 3.0% are. [Nielsen] However, the convenience channel has made some progress since Asahi UK’s last update six months ago, when just 2.7% of SKUs were no- and low-alcohol beers.

Peroni Nastro Azzurro 0.0% is the stand-out performer within No & Low Lager. Sales are up by nearly £1m, and the brand has added the most value out of any no- and low- lager brand to the convenience channel in the past 12 months. [Nielsen]

Peroni Nastro Azzurro 0.0% also recently became the number one no- and low- packaged lager in the on-trade by both value and rate of sale. [CGA]

But three in five convenience stores are still not stocking Peroni Nastro Azzurro 0.0% and may be missing out on sales as a result.

Insight-backed no- and low-alcohol merchandising advice

1. Group no and low products together. More than seven in 10 shoppers want to see no- and low-alcohol products displayed together, not next to their alcoholic product equivalents. [Bulbshare]

2. Use clear signposting. Sixty-nine per cent of shoppers say retailers should use signage highlighting ‘no alcohol’ and ‘low alcohol’ for the corresponding products, rather than mention specific ABVs. [Bulbshare]

3. Make no and low part of dinner meal deals. More than half of shoppers think offering alcohol-free beer as an option with a dinner meal deal in a retail store is a ‘good idea’. [KAM]

Key no- and low-alcohol beers to stock

Retailers should stock at least these three key SKUs to win their fair share of the no- and low-alcohol beer opportunity.

1. Peroni Nastro Azzurro 0.0% 4x330ml. The brand has added the most value out of any other no- and low-alcohol lager brand to the convenience channel in the past year. Its four-pack has the highest rate of sale of all no- and low- lager small packs in the channel. [Nielsen]

2. Heineken 0.0 4x330ml bottle – The number one no and low lager brand by value sales[Nielsen]

3. Guinness 0.0 4x440ml cans – The number one no and low beer SKU by value[Nielsen]

Building your range with premium lines

If you’re looking to go beyond the three core SKUs for your no- and low-alcohol beer range, Asahi Super Dry 0.0% is a premium contender.

First launched in 2023, the brand won gold at the first World Alcohol Free Awards, with judges describing it as “indistinguishable from a full-strength version”.

The brand is growing ahead of the no- and low-alcohol beer category, with value sales up by +33% in the past 12 months.

What to do next

If you’re looking for support on how to grow your no- and low-alcohol beer sales and profits, get in touch with Asahi UK by emailing communications@asahibeer.co.uk