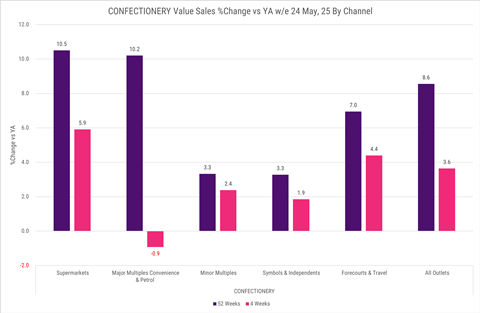

Confectionery market value sales are +8.6% up over the last 12 months (L12M) versus (vs) the last year (LY). Growth is very much price driven with average price per kg up +7.9% in the L12M vs LY, but volume (kg) is also just up on last year in the L12M by +0.7%. Growth has been driven in the main by the chocolate category which including seasonal chocolate is up +10.4% in the L12M vs LY, again predominantly driven by price with volume just up on last year by +0.5% in the L12M.

Of the three categories within confectionery, sweets, gum and chocolate all are in growth, with gum the only category to see volume sales decline over the L12M.

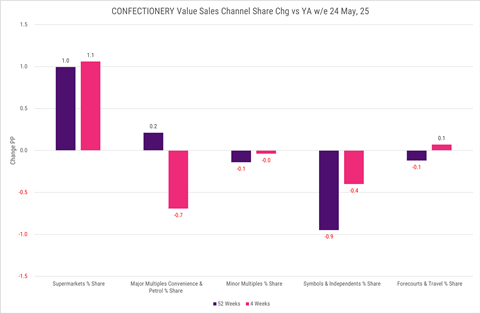

The symbols and independents channel has a significant over trade in confectionery with a market share of 18.6 PP but is under-performing the market dropping 0.9PP of value share in the L12M to major multiple grocer supermarkets.

The channel is growing value sales but growth is coming exclusively through price, with volume sales down across all categories vs last year in the L12M, most significantly in chocolate were volume sales were down -5.2%. Channel performance has picked up in the latest 4 weeks vs LY, but this will most likely be a short term weather-related boost.

No comments yet